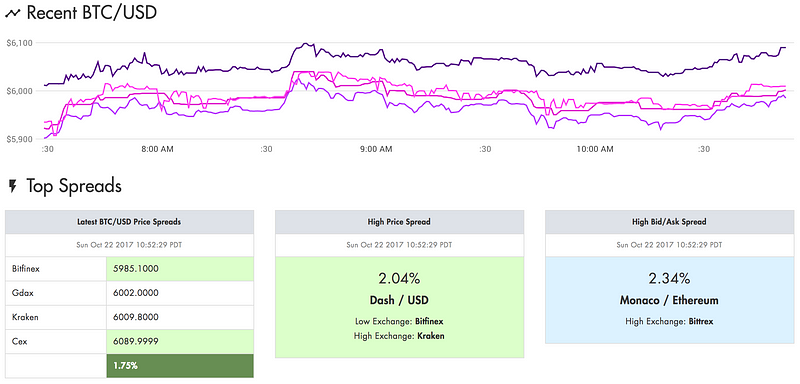

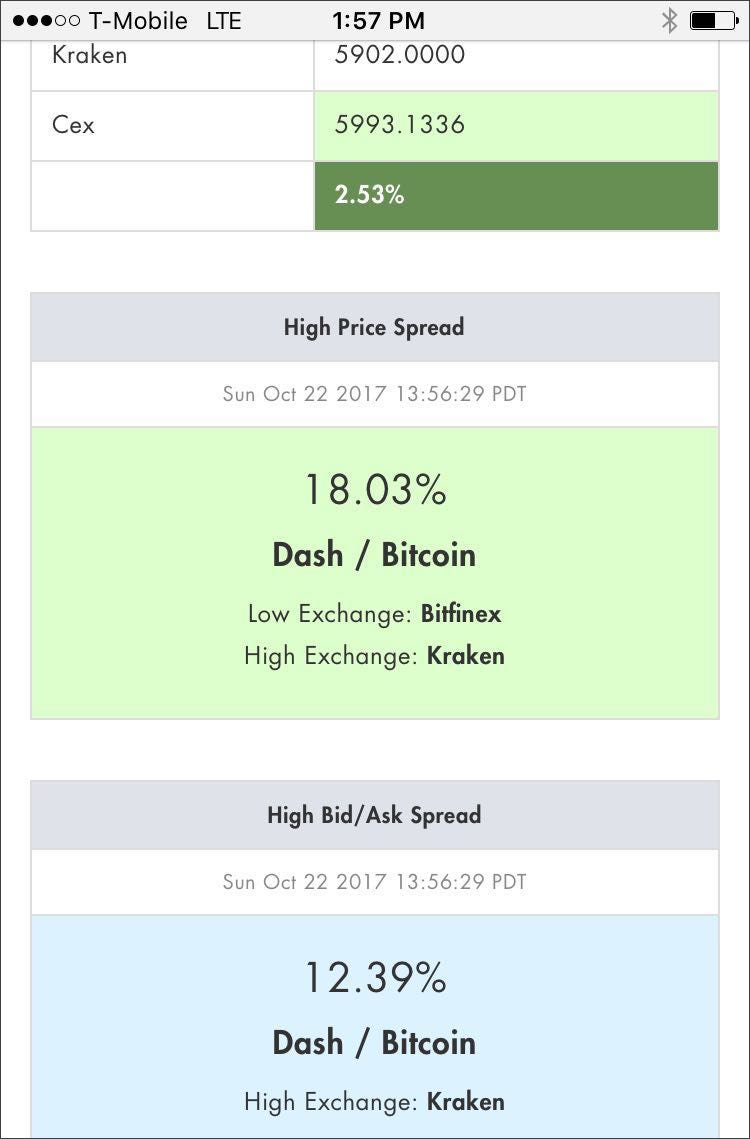

Introducing — Token Spread: Simple bitcoin/crypto spread monitoring for arbitrage.

I recently launched a personal project to monitor price and bid/ask spreads for many of the popular cryptocurrencies across a handful of exchanges.

My scope of experimentation has been:

- Inter-exchange Manual Arbitrage

- Intra-exchange Automated Arbitrage

I’ve been tracking currencies like Bitcoin (BTC), Ethereum (ETH), Monero (XMR), Ripple (XRP), Neo and many more—across exchanges like Bitfinex, Bittrex, Kraken, Gdax and several others.

Overall Confidence

There is enormous potential for cryptocurrency arbitrage, with many signals and many opportunities each day. Some opportunities require full automation to be practical.

Crypto Market Problems

- Volume

Volume is low. Really low. Clear signals that are actionable are often constrained by volume. - Bid/Ask SpreadsBid/Ask spreads are quite high on the low-volume pairs. This introduces a lot of variability and impacts predictability of opportunity signals.

- Order Books

Because volume is low, order books are thin. This means that the ‘depth,’ or available interest at different prices is quite thin, which makes understanding the full scope of an opportunity much more complicated. For example, there may be a great trade that can net 5%, but only with a maximum of USD$3,000. The next opportunity might net 3% with an opportunity size of $5,000. And so on. - Network Transfer Speeds

Network transfer speeds are VERY unpredictable. Bitcoin (BTC) transfers between wallets can be anywhere from 10 minutes to 8 hours. Network health and bandwidth is the key factor here. BTC has different considerations than ETH, and so on. We can talk more about mining fees and their impact on these transactions, but that is largely obfuscated from the exchange investor at present. - Exchange ReliabilityThe exchanges are reasonably reliable. However, they are not even close to the level of an E-Trade or Interactive Brokers or Bloomberg Terminal. Not even close. Some of the exchanges have been shut down by governments. Some of the exchanges scale way too fast, like Kraken. Sometimes trades are not executed because of server overload. Some of the exchanges’ API endpoints are quite unreliable at times.

The Average Investor

The average investor should play it safe. Transfer times are scary and unpredictable. Crypto as a larger segment has proven its value and staying power. It might be more practical for a layperson investor to familiarize themselves with the main blockchain concepts first in order to understand why people are getting excited about different currencies. Maybe Bitcoin emerges the overall winner, perhaps not. Don’t get romanticized by the numbers that the media trumpets about market cap and all the rest, I’m not convinced that the various exchanges have proven these claims with real volume and trading activity.

What Does The Future Look Like?

Who knows… The crypto market is emerging at an incredible pace. It is here to stay. Does Bitcoin win? Ethereum? Qtum? Zcash? Ripple? We really don’t know. Whatever happens, it’s going to be a fun ride.

One note of caution: We don’t yet know how Bitcoin and the cryptocurrencies will respond to a significant downturn in the larger markets like the Dow, S&P and Nasdaq. We know that Bitcoin has so far outperformed the primary US markets by factors. Be careful out there. It’s been very easy to be ‘right’ about the crypto markets in the last 24 months, perhaps that should be reason for a healthy amount of caution.

Aucun commentaire:

Enregistrer un commentaire